WHAT IS TAX ABATEMENT?

A property tax abatement is a financial tool offered by government entities to support development projects that would otherwise be too expensive to build. The abatement eliminates, or significantly reduces the amount of taxes that a developer pays on a piece of property for a specific period of time; thereby freeing up funds which can then be put toward the cost of constructing the project. A property tax abatement does not affect other taxes the municipality, or other local governments receive such as payroll taxes, income taxes, and sales taxes. A property tax abatement is NOT a tax increase. It is a temporary redirection of future property taxes.

In the case of Belle Oaks at Richmond Road, the cost of constructing and maintaining a high-quality, mixed use development of this caliber requires the use of some public funds in the form of these tax abatements. Belle Oaks developers wish to utilize two consecutive abatements of 15 years each; otherwise the project is not economically feasible and will not be built.

UNDERSTANDING DEVELOPMENT FINANCING

While in some ways, financing a development like Belle Oaks at its $250,000,000 price tag is significantly more complicated than the mortgage loan you would take out on your home, in other ways it is surprisingly similar.

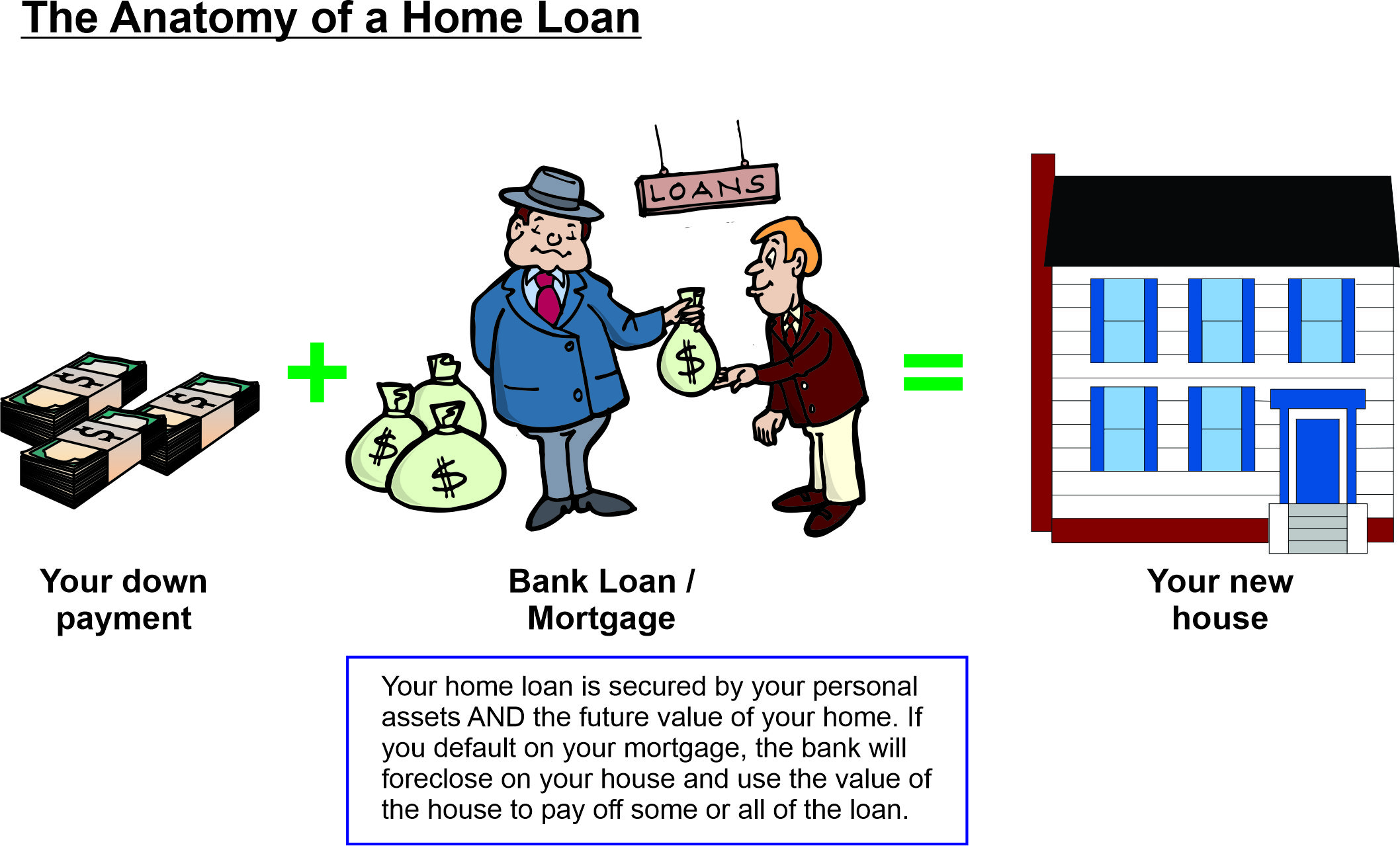

Home Loan Financing

For instance, to purchase your home, you would put down some money of your own as a down payment. You would then borrow the rest from a lender in the form of a mortgage loan. You would secure that loan with something tangible, like other personal assets you have, including your future salary and the value of the home you are purchasing.

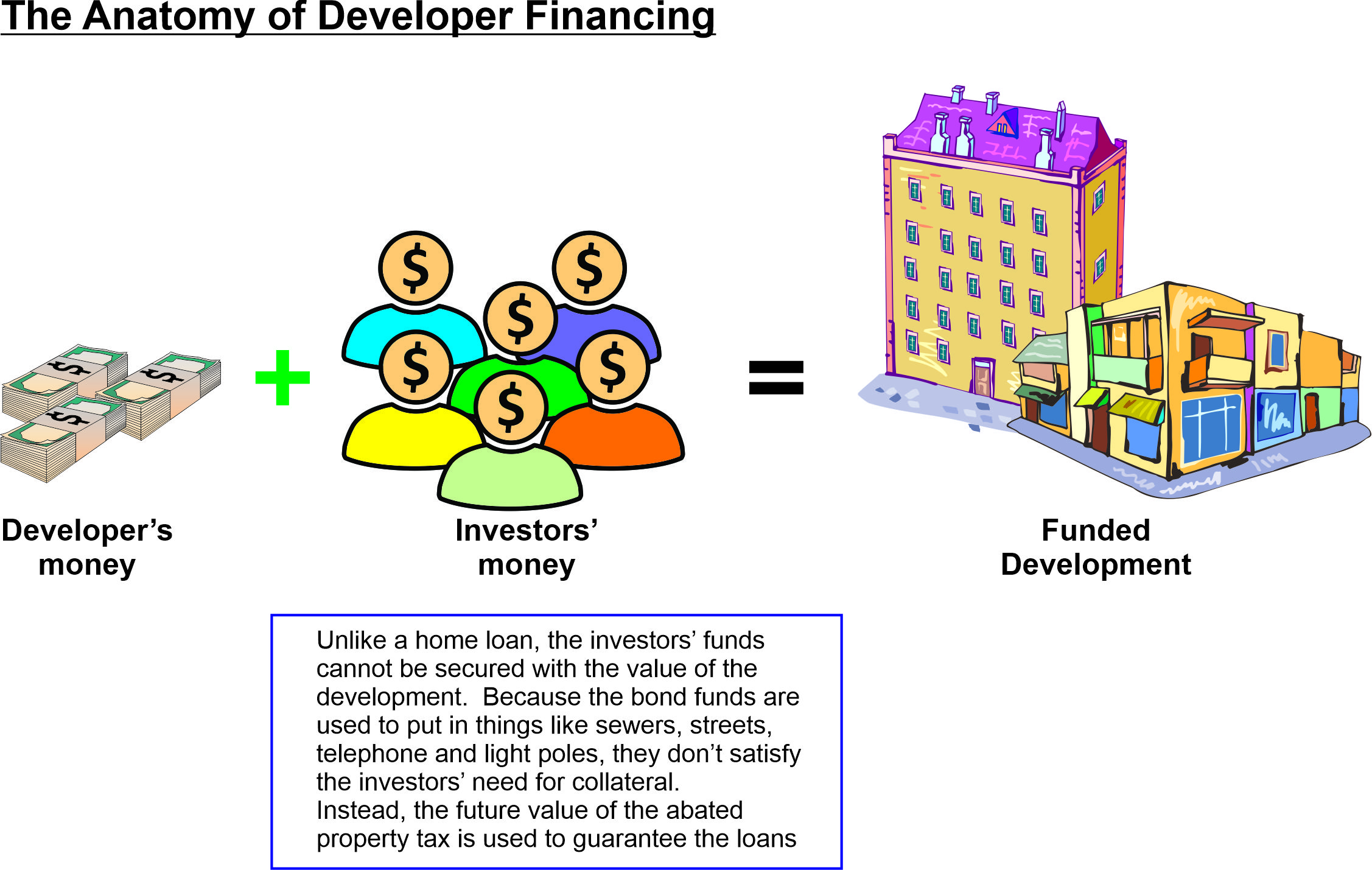

Developer Financing

Similarly, a development like Belle Oaks requires a cash down payment from the developer, as they are significant stakeholders, and then the remaining, necessary funds from lenders who serve in a role similar to that of the mortgage lender above. In the case of the development, particularly one that is using abatement funds, since the abated funds pay for the development’s infrastructure (things like sewers, roads, streetlights, electrical grids, and ground leveling, etc.) those things cannot be used as collateral. Instead, the developer uses the future value of the abated taxes to guarantee the loans .

Wage Affordability Gap

For illustration purposes, suppose you don’t qualify for the new home purchase because your salary is not high enough. Then what? This “wage affordability gap” must be corrected in order to get the lender the approve the loan, or the price of the new home purchase needs to be lower;

The same dynamic applies to Belle Oaks. The high cost of new multi-family construction in today’s world, compounded by COVID unemployment and a national recession, creates a “wage or affordability gap” in the sense that apartment rents in Richmond Heights must be much higher; otherwise, the banks won’t finance the construction of the project.

Closing the Gap

The State of Ohio recognizes the reality of new construction and has proactively created several financing vehicles to allow cities like Richmond Heights to attract investors and new development; creating long term value for its residents and schools.

The most common method to close this “rent affordability gap” is the use of tax increment financing. Called, TIF for short, this financing option for blighted areas, like the Richmond Town Square Mall, effectively lowers the cost of new construction using a portion of the future property taxes to support a private infrastructure and development bond, funded by private investors.

Bond Proceeds Close the Gap

Bond proceeds close the “gap” by lowering the effective cost of new construction; allowing the project to be built and charge affordable rents. Bond proceeds are used to defray many of the “hidden costs” of infrastructure, such as roads, sewer and water lines, grading the land, bringing upgraded electrical and natural gas lines to the property, public parking, outdoor lighting and life safety systems, to name a few items. Other costs include consultants, construction labor as an example. The hard costs of construction, consisting of building materials, are financing by the construction lender.

Getting back to the home purchase illustration, to complete this thought, the bond financing, lowers the “wage affordability gap” of buying the new home by effectively lowering the price. The price is lowered by deducting the value of the public infrastructure items from the purchase price such as the implied value/cost of sidewalks, water hookups, sewer lines, electricity and natural gas lines, etc. as an illustration. In this case, the “wage or affordability” gap is closed.

THE MECHANICS OF FINANCING FOR BELLE OAKS AT RICHMOND ROAD

THE CRA (COMMUNITY REINVESTMENT AREA) [YEARS 1 TO 15]

The first 15 years of the life of the Belle Oaks project will be covered by the Community Reinvestment Area, or CRA abatement program. This State-created abatement program has been in effect since the 1960’s. The City expanded this area to the mall property in December of 2019.

With the CRA abatement, the property taxes are divided into two buckets. One bucket is the land value and the second is the value of the buildings that will be built on the land. The property taxes on the value of the land, including any increases in land value, will continue to be paid to both the City and the schools and are not abated. The property taxes on the building values will be abated and the tax savings is used to service (pay down) the debt created by the investors’ bonds.

In the case of the schools, the Ohio CRA law offsets the redirected property taxes with a split between the City and schools of the income taxes, first paid by the construction workers who will create Belle Oaks, and then by the employees who work for the Belle Oaks property and any businesses that locate at Belle Oaks as part of the development. Taxes for pre-existing businesses such as Cube Smart, the Movie Theater and the Fitness Center are not included in the income tax sharing, but these property values are also pre-existing, so the property taxes are not abated.

TIF FINANCING (TAX INCREMENT FINANCING) [YEARS 16 TO 30]

The second period, years 16-30 of the life of the Belle Oaks program, will be covered by the Tax Increment Financing or TIF. Similar to the CRA, the TIF a State-enacted program that also dates to the 1960’s. The TIF program permits an agreement between the Developer and the City to defer the payment of certain property taxes, for a specific period of time, in order to provide the necessary funds to redevelop or, improve typically blighted areas. TIF funds are almost always utilized to build, or improve, infrastructure in a blighted area. In the case of Richmond Town Square Mall (certainly blighted), the funds will be utilized for many expenses, including to build out sewers, streets, electrical grids, safety lighting and to level the property to make it suitable for the construction of a new development.

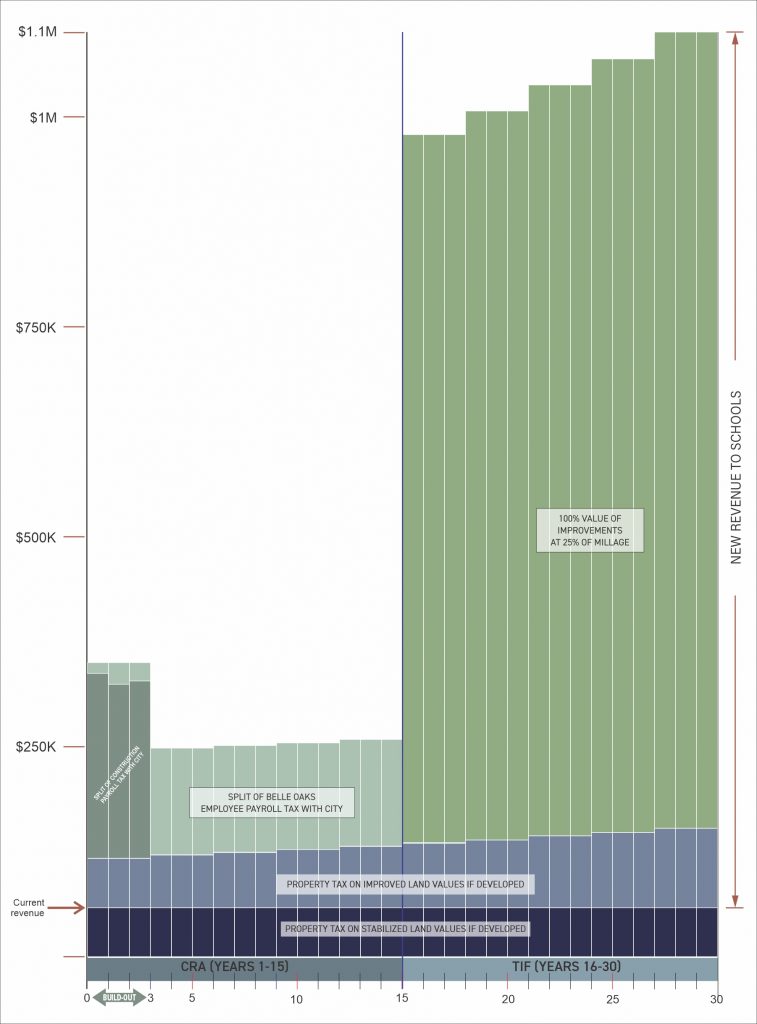

In the case of the schools, they will continue to collect 100% of their property taxes from the land and any increases in land value (same as under the CRA). On the value of new building improvements, starting in year 16, 75% of the value is exempt and 25% of the value is paid, so the schools will receive payments on new building values equal to 25% of the school’s millage rate. The schools will continue to receive 100% of the taxes paid on existing building values such as Cube Smart, the Movie Theater and the Fitness Center. The chart below shows the relative values of the compensation the schools will receive for each of the periods in question.

VALUE TO THE SCHOOLS

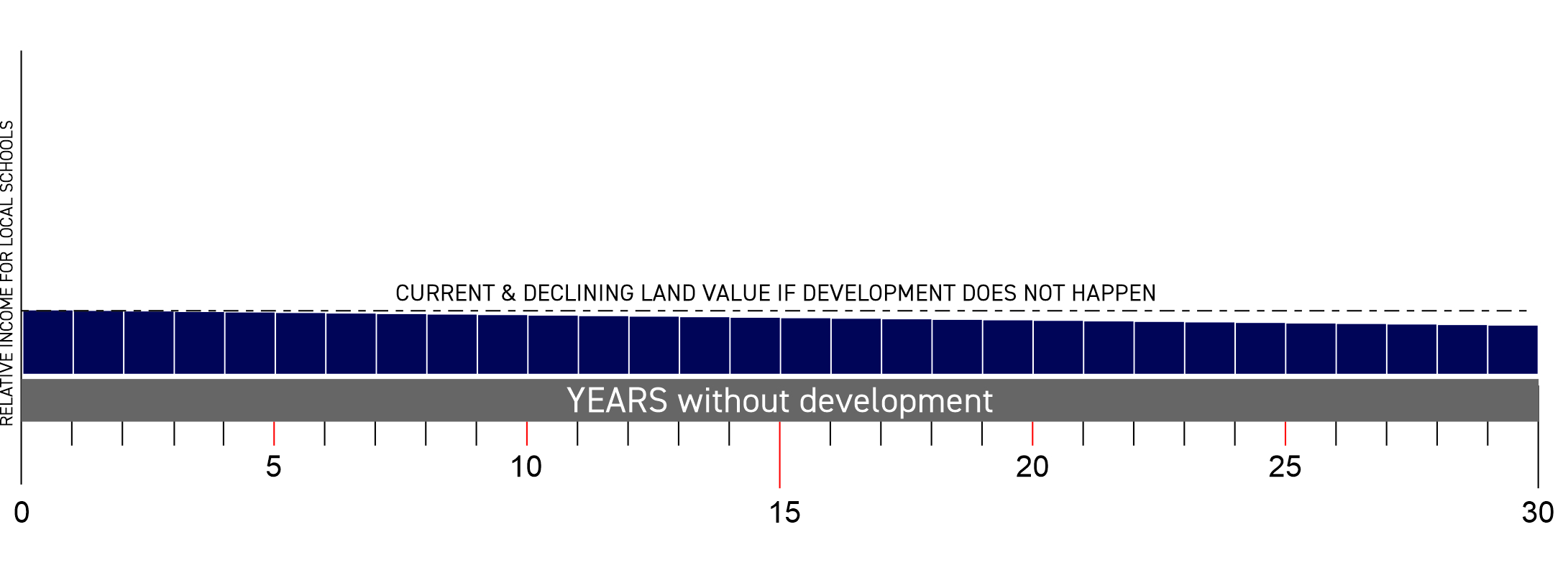

What property taxes look like without development

In order to understand the relative value of the Belle Oaks Development to the schools, let’s first look at the relative property taxes that one could project if Belle Oaks does not proceed. Property taxes would begin at their current levels and then slowly decline over time as the property values continue to slip.

What relative property taxes look like with the Belle Oaks Development

Now let us look at the values for each of the property tax abatement periods. As you can see, not only are the taxes NEVER 100% abated, but the schools receive new, additional income for each of the 30 years.

Income to the schools is significantly more with development than without; though it is impossible to accurately predict the amount that the schools will receive in taxes. DealPoint Merrill does not determine the value of either the land, or the buildings. These valuations are determined by Cuyahoga County and will not be determined until the project has started and then, once it is completed.

Disclaimer: Property and Payroll taxes projected based upon Cuyahoga County Tax records for years prior and Impact Study conducted by Project Management Consultants LLC of Cleveland, Ohio – August 2019

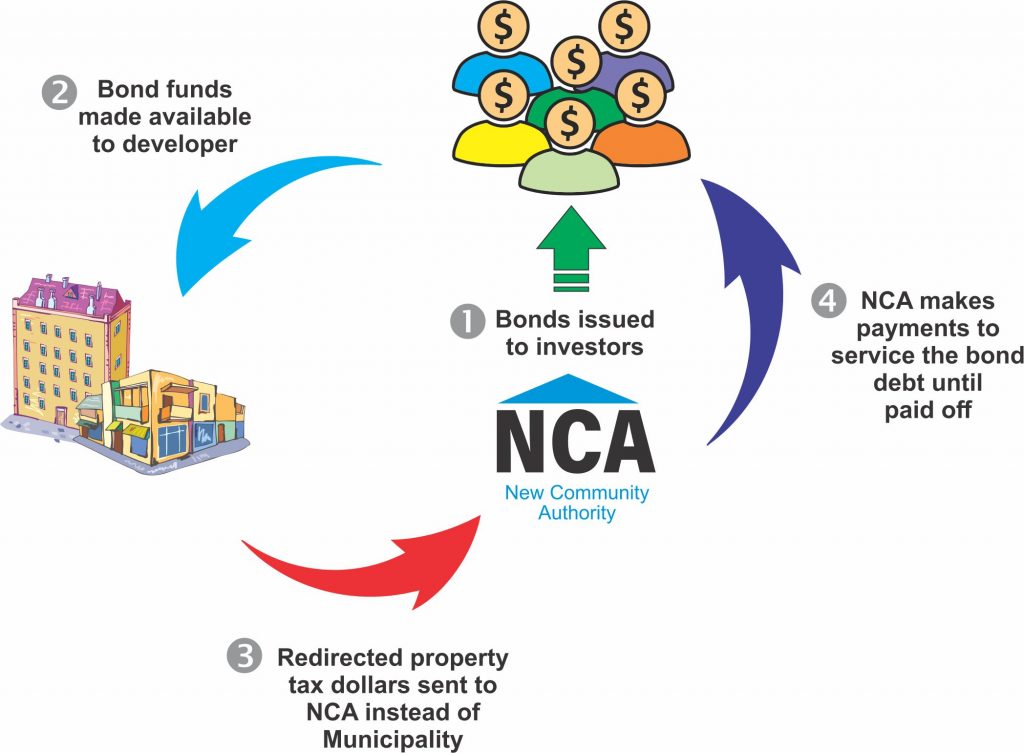

WHAT IS THE NCA?

The NCA, or New Community Authority, is a board created by an act of City Council under the authority granted by Ohio Law. Ohio’s NCA is also an established law, first enacted in 1972. The NCA is made up of an uneven number of members representing both the City and the developer. The uneven number always favors the City. In the case of the Belle Oaks at Richmond Road project, the NCA consists of seven (7) members; four (4) from the City and three (3) appointed by the developer.

The NCA is a Bridge

The NCA serves as a bridge between the City, the developer and the investors. The role of the NCA is to serve as the gatekeeper for the abatement funds and to ensure that these funds end up servicing the debt created by the bonds. Additionally, it is the NCA and not the developer who initially offers the bonds for sale and, being a quasi-governmental agency, the NCA can offer the bonds at a more attractive rate for investors. In the end, this saves taxpayers money since more of the abated funds go towards principal and less towards interest. The use of an NCA at Belle Oaks enables the developer to avoid asking the City to guarantee the debt. This is significant for the community because the City can, though the use of the NCA, sponsor hundreds of millions of dollars of new investment without putting its own credit on the line.