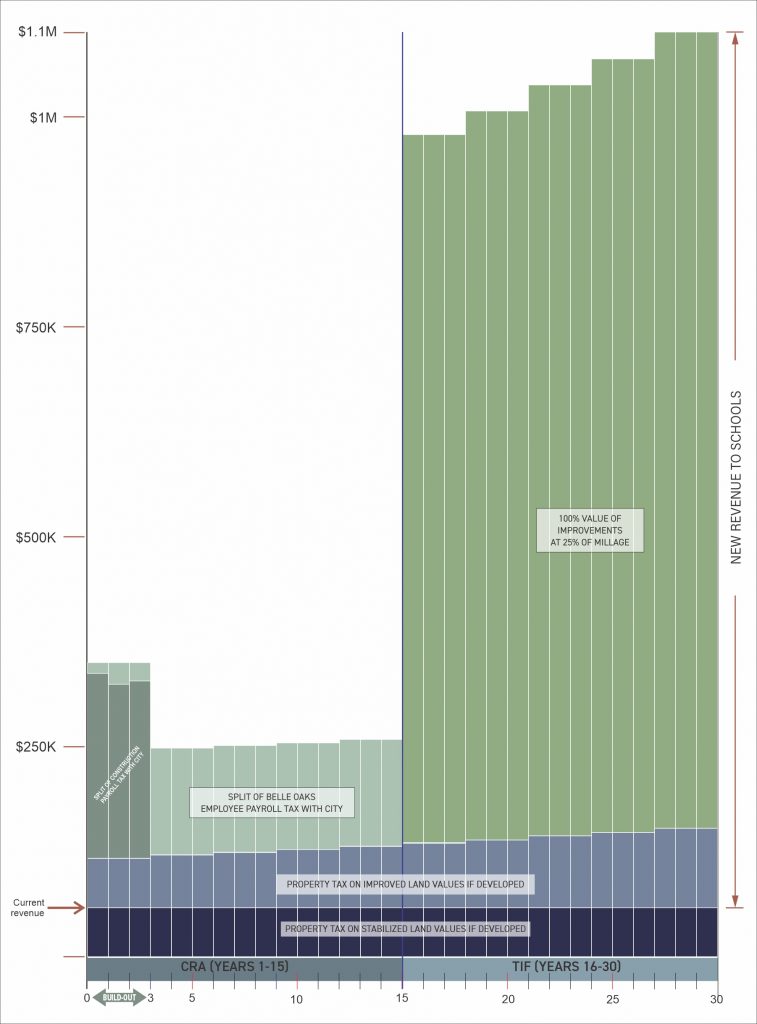

IF BELLE OAKS DOES NOT MOVE FORWARD

- The mall remains in its current condition, or worse, and Richmond Heights Local School District and the South Euclid-Lyndhurst School District receive the same, or less, in property taxes than they currently receive.

- RHLSD currently receives approximately $58K per year from the former Sears property. SELSD receives approximately $200K per year from the remainder of the mall.

IF BELLE OAKS MOVES FORWARD

IMMEDIATE BENEFITS TO LOCAL SCHOOLS

- South Euclid-Lyndhurst Local Schools receive an immediate infusion of back property taxes owed. The expectation is that more than $700K will be paid to the district.

NOTE: Richmond Heights already received its back taxes owed when the Sears property was acquired by DealPoint Merrill.

YEARLY BENEFITS TO LOCAL SCHOOL DISTRICTS

- Local schools receive 100% of property tax on improved land values. For Richmond Heights the estimated payment would be approximately $130K/year. For South Euclid-Lyndhurst that amount is projected to be at least $300K/year.

- Local schools will receive a portion of payroll taxes for years 1-15. For each of the two districts, the average amount is potentially an additonal $147K/yr. The actual amount will be determined by negotiations that have not yet concluded between the City and the two school districts.

- Local schools receive 25% of the school property taxes on 100% of improved building valuations for years 16-30. For both local school districts the average estimated amount is more than $900K per year.

SUMMARY (two separate school districts)

- During years 1-15, Richmond Heights Local School district is projected to receive as much as $277K per year.

- During years 16-30, Richmond Heights Local School District is expected to receive an average of nearly $1M per year.

- During years 1-15, South Euclid-Lyndhurst Schools are projected to receive as much as $477K per year.

- During years 16-30, South Euclid-Lyndhurst Schools are expected to receive an average of $1.2M per year.